There is no highest, only higher! This week, the Chinese domestic steel price up to a new point, which aroused strong concern from all parties in the market.

The Status of Chinese Steel Industry

On April 2nd, the main rebar futures contract closed at 5,157 RMB/ton, the highest since March 2011, and the cumulative increase this year is about 18%. Hot-rolled coil and wire rod futures have reached new highs since the listing of futures products, with cumulative increases of 22% and 15% respectively this year. As a bulk commodity, why the increase in steel prices make people so nervous? Why the price soared?

Why the price of steel and related products soared?

1. Chinese government published supply-front economics policies

At the 11th meeting of the central finance and economy leading group on Nov 10, 2016 President Xi Jinping stressed that China should strengthen structural reform of the supply front to increase the quality and efficiency of supply system and provide a growth impetus for sustainable economic development.

At present, China’s reform of the supply front during the new normal is a comprehensive strategic deployment that involves various aspects including industries, macro control, capital and the fiscal and taxation systems.

What’s the main content of the supply- fron economics?

excessive production capacity

industrial optimization and reorganization

reducing costs

keeping their competitive edge

The direct effect to steel induetry is the decrease in production and increase in price.

2. Production restriction policy

Because of the restriction policy, the output of the biggest steel supplier, Tanshan City, will reduce about 150 million tons.

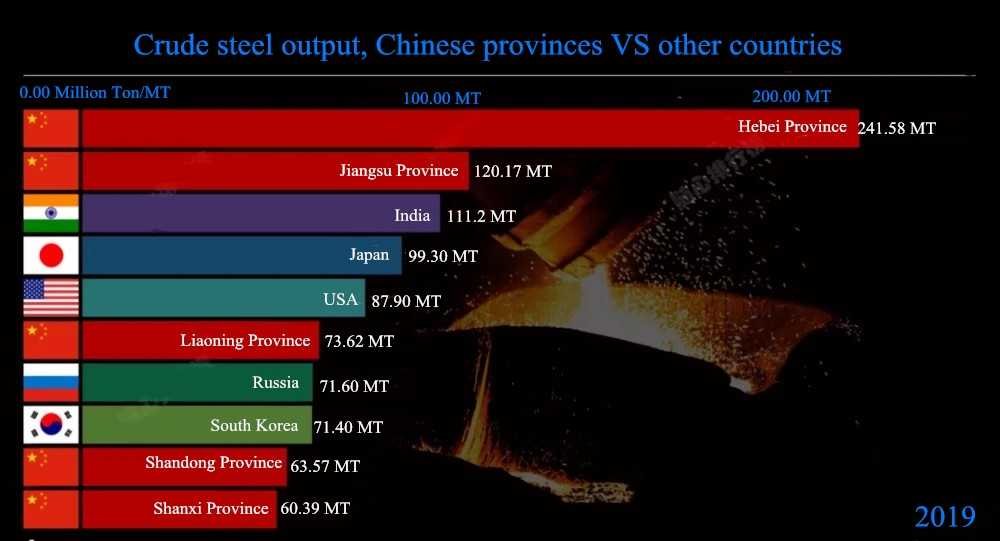

Here is the Chinese steel production condation compared with other countries

From this point of view, Hebei is the largest steel base in China and even the world, and Tangshan has the highest output in Hebei. So, the restriction policy will restric the output of Tangshan, and the price be affected.

3. Inflation

Since last year, Western central banks, represented by the Federal Reserve, have launched an epic easing stimulus policy, and global currencies have released a lot of water. The Fed released $3 trillion to the market in just one month in March 2020, which is equivalent to one year’s GDP of the United Kingdom.

Additional currency issuances of this magnitude will inevitably have an impact on asset markets and commodity markets. This year, with the widespread promotion of vaccines and the gradual control of the new crown epidemic, consumer demand and production demand brought about by the global economic rebound, coupled with a temporary lag in market supply, global inflation is bound to strike strongly. The global financial market is full of “liquidity violence”, and the prices of commodities such as energy, non-ferrous finance, and raw materials have almost all risen. The proliferation of liquidity has reached the level of “scrolling everywhere.” Bitcoin magically rose, black futures also fluctuated upwards, coupled with the cautious attitude of spot merchants, making steel prices continue to rise.

4. Impact of the epidemic

Since last year, the epidemic has been affecting the world economy, many countries have block airports and seaports, which makes the ships and containers less and less. Transportation companies take the opportunity to raise the price, the additional cost finally is paid by the importers. In order to keep enough profit, importers have to raise the price. A slight move in one part may affect the whole situation. Who will pay for the increase?

5. Australia government restric the iron ore exporting to China.

This didn’t affect Chinese market much, but the market also chaged for it.